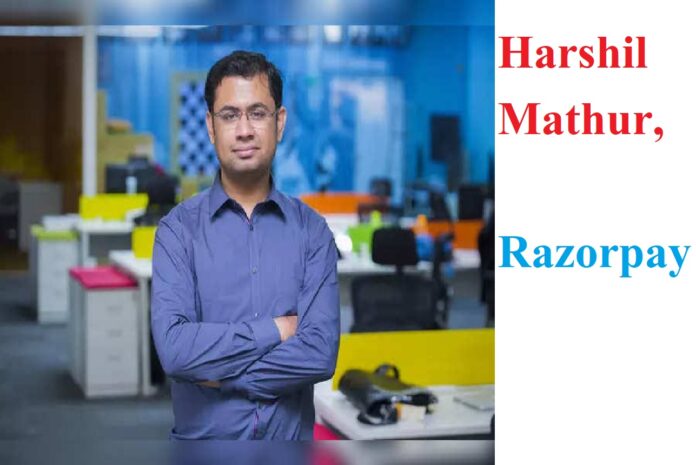

(Mohan Bhulani, NTI) : In a world where perseverance is often the key to success, Harshil Mathur’s story stands as a testament to unwavering determination and innovation. At just 23 years old, Harshil, a software engineering graduate from IIT Roorkee, embarked on a journey that would see him face rejection 100 times before founding Razorpay, a company now valued at a staggering 60,000 CR.

The Early Struggles and Breakthrough

Harshil’s career began as a Wireline Field Engineer at Schlumberger, a US-based oilfield services company. Despite a promising start, his passion for software development remained. This led him to run a crowdfunding website, which highlighted the challenges small businesses faced in securing payment gateways due to cumbersome documentation processes. Determined to address this issue, Harshil approached numerous banks, only to be met with rejection after rejection.

However, his persistence paid off when HDFC Bank recognized the potential of his vision. Leaving behind a high-paying job, Harshil founded Razorpay in 2014, focusing on providing startups with a seamless payment solution.

Razorpay’s Rise to Prominence

Within a year, Razorpay had attracted 400 businesses, and its early success led to an investment of 74.7 lakhs from Y Combinator in 2015. The company’s transparent pricing model, offering transaction fees of 2% and 2.5%, resonated with businesses, leading to a partnership with 50 banks and expansion to 1800 businesses.

A Turning Point for Digital Payments

The landscape of digital payments in India shifted dramatically with the 2016 demonetization policy and the introduction of the Goods and Service Tax (GST) in 2017. These events opened the eyes of the very banks and venture capitalists that had once dismissed Harshil, as they now saw the untapped potential in the 30 million underserved startups and MSMEs in India.

Exponential Growth and Innovation

By 2019, Razorpay had grown 500-fold, serving 350,000 clients and launching innovative services like RazorpayX and Razorpay Capital. Despite the challenges posed by the COVID-19 pandemic, the company pivoted towards booming sectors such as e-commerce and online education, handling 74% of small business transactions in India.

Achieving Unicorn Status

On October 12, 2020, Razorpay raised 721 CR at a valuation of 7300 CR, earning the prestigious title of India’s 32nd unicorn and the fifth to achieve this milestone during the pandemic.

Today’s Razorpay: A Fintech Giant

Now, Razorpay stands as the largest digital payment processing company in India, with an annual total payment volume of 12,00,000 CR. Harshil’s journey from being the son of an SBI clerk to the helm of a fintech giant is not just inspiring but a beacon for aspiring entrepreneurs across the nation.