The financial consequences are beginning to be seen in the first wave of company earnings since the double strike started.

Hollywood studios, streamers, and associated businesses have started anticipating decreased income, content spend, and, in some cases, a weaker outlook for the year while hoping and planning for a resolution in September. Because even though some people might be able to temporarily stop the production, as the strike drags on into the fall and the release timetable slips, the financial risk grows.

The company Endeavor, which owns the talent agency WME, may have had the worst effect to date. On August 8, CFO Jason Lublin issued a warning that the company anticipates a decline in revenue of around $25 million per month for the quarter ending September 30. The company retracted its full-year guidance because of uncertainty regarding the strike’s duration and financial impact.

Specifically in its 3 Arts Entertainment talent and television operations, the studio estimates a revenue hit of around $30 million for the current quarter, according to Lionsgate CFO James Barge on August 9. However, if the strikes conclude in September, management reiterated its operating income forecast of $400 million to $450 million for fiscal 2024. “If it goes longer, it has a similar impact, probably, as it rolls quarter-to-quarter,” said Barge. “We expect things to be resolved, and we return to work in the middle of fall.”

Warner Bros. Discovery revised its 2023 guidance and expects to come in at the low end of the range, at $11 billion to $11.5 billion in adjusted earnings before interest, taxes and depreciation, as a result of the shutdown of content production as well as advertising difficulties. The company noted that the strikes had produced savings in the “low $100 million range” for the second quarter. Although the company is maintaining “fluid” release dates for the remainder of the year, CFO Gunnar Wiedenfels stated that the outlook implies the strikes would end in September.

“Given the ongoing strikes, release dates and performance expectations are naturally variable for the remaining feature films we’re releasing this year, as well as for Warner Bros. television programs. We’ll assess our alternatives and update the market as necessary. However, it’s feasible that the fluctuation will be bigger than what we predicted, according to Wiedenfels.

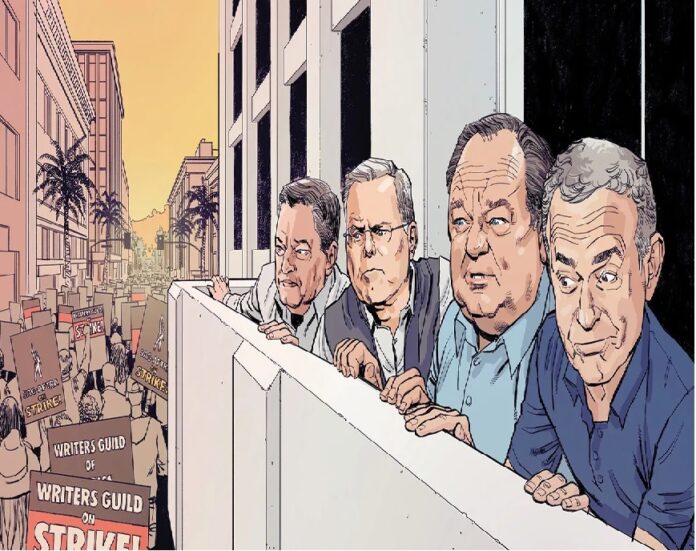

SAG-AFTRA has been on strike since July 14, while the Writers Guild of America has been on strike since May 2. Due to the ban on actors promoting their projects, production on the majority of American-based projects has halted. In addition, broadcast networks have been rearranging their fall schedules, heavily relying on acquired series and unscripted shows. The Alliance of Motion Picture and Television Producers and the WGA began negotiations on August 11, but many believe a resolution is still far off.

Despite the fact that expenditure on production and other associated costs has decreased, there are still some benefits from the strikes for studios and entertainment companies, including an increase in free cash flow. However, those advantages will probably be lost when the strikes finish and production begins. And as the strikes drag on, the financial hardships will worsen. According to managing director at Wedbush Securities Michael Pachter, if it settles today, it will have almost little impact. “It will have some effect if it goes on for two to three more months. If it goes on for a year, the effects will be disastrous.

The strike has the most immediate impact on the entertainment industry’s talent agencies, but enterprises with exposure to the linear TV industry—particularly the TV advertising industry (apart from sports)—will experience difficulties later. All of the broadcast networks’ sources claim that their 2023–24 upfront commitments were flat compared to last year, as opposed to prior years when they witnessed increases. Only very tiny, low-single-digit growth was mentioned by those who claimed improvements, and this was attributed to live sports like the NFL or enhancements in their streaming selections. The upfronts in May included very little scripted programming, and advertisers have been hesitant to invest a lot of money in an unreliable entertainment schedule, preferring to wait for the spot market (where they can put advertisements closer to their run date).

Advertisers are hesitant to purchase TV inventory without knowing the scheduled content, according to a research note from S&P Global’s Naveen Sharma dated July 10.

In the meantime, a Netflix insider claims that during its upfront negotiations, the streaming giant “took share from traditional TV broadcasters as well as digital video platforms.”

Thanks to its extensive collection of content and global production capabilities, many believe that Netflix is the streamer most suited to weather the strike. When asked if or when Netflix might run out of original material during the company’s July 19 earnings interview, co-CEO Ted Sarandos remained evasive but noted that the streamer creates “heavily across all kinds of content” including unscripted, scripted, domestically and globally. If the strike continues, the abundance of content might possibly attract more subscribers.

“Like COVID, in a prolonged Hollywood strike, NFLX likely gains share of engagement,” Wells Fargo analyst Steven Cahall wrote in a research on July 19.

As a result of the strikes, Netflix predicted lower cash content spending in 2023, with the assumption that it would increase to normal levels in 2024. (Disney also mentioned lower content investment during its results call on August 9; it predicted that spending for the year would be around $27 billion, down from earlier projections of $30 billion.)

In order to lessen the effects of the U.S. strike and lower customer turnover, some streamers, like Paramount+, have highlighted their capacity to draw on worldwide multiplatform content over the course of the next three months or more. But according to Third Bridge analyst Jamie Lumley, as the strike goes on, Paramount will likely be more negatively impacted on both the studio and streaming sides of the industry because its streaming business is more dependent on programming from its linear networks.

The company has completed a “significant number” of feature films, including Killers of the Flower Moon and Bob Marley: One Love, and has more than 85 international scripted and unscripted Paramount+ Originals currently in development, production, or greenlit, Paramount Global CEO Bob Bakish assured investors on the company’s earnings call on August 7. Bakish did add that the strikes “present some marketing challenges,” which the studio is taking into consideration as it relates to the release of the movies. Additionally, executives stated that some originals, which were formerly planned for release on Paramount+ in Q4, will move to 2024 “due to strike-related production delays.”

Even while Fox has more news and sports programming to fall back on than other linear networks, and Netflix is more insulated from the effects of production shutdowns among streamers, Cahall said in an article on August 11 that “It’s tough to see a relative winner from the writers/actors strike.” Even if a solution is found, businesses like Fox are warning of increased expenses that would probably be connected with the new contracts.

Investor ambiguity on the duration of the production halt until then adds to the expanding list of strike-related pressures facing Hollywood studios.

This study was made possible by Alex Weprin.