How Mukesh Ambani Plans to Strengthen His Companies Over the Next Decade

Reliance Industries is prepared to begin on a journey of wealth unlocking on May 2nd, in a critical move. Reliance Industries, India’s largest firm, engages in a variety of industries ranging from petrochemicals to retail and telecommunications. Shareholders will get shares in Jio Financial Services during an upcoming board meeting, a decision that has the ability to set the stage for the company’s future endeavors.

Using User Data to Improve Financial Services

With 426 million users, Reliance Jio possesses a tremendous asset in the form of user data. This information includes customer search trends, demographic profiles, and preferences. The company is well positioned to use this data to underwrite consumer lending. This strategic maneuver has the ability to change the game. While loans to India’s middle class have increased by a modest three percent in the last year, lending to the sector has increased by only seven percent. This disparity demonstrates the reasoning behind Reliance’s plan to split off its financial services unit. As a result, the company intends to list itself independently on stock exchanges. This action may eventually open the path for its telecom and retail companies to be listed separately.

Taking Advantage of Market Opportunities

According to Jefferies, a leading brokerage firm, catering to India’s consuming class has huge market prospects. Home loans, vehicle loans, consumer durable loans, microfinance, and the fast increasing personal loan industry are among the market categories. These portions constitute a significant whitespace that Reliance can exploit. The company’s access to low-cost funding as a result of Reliance Industries’ strong credit rating is a significant benefit for this business.

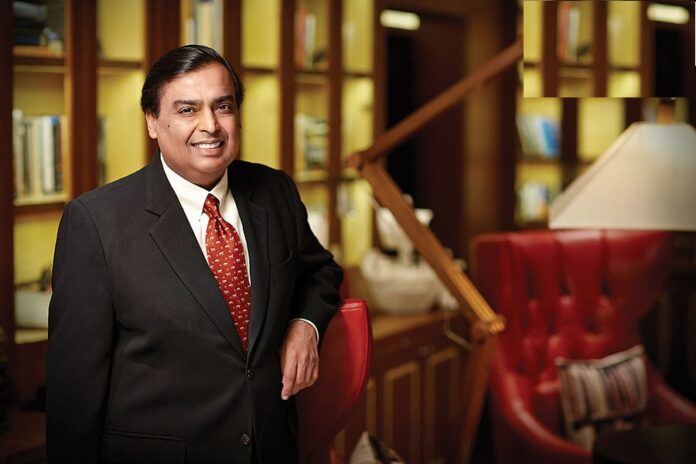

Mukesh Ambani’s Strategic Initiatives

Mukesh Ambani, Reliance Industries’ driving force, has been tirelessly leading the company toward a brighter future. Ambani, who is ranked ninth on Forbes’ 2023 list of world billionaires with a net worth of $83.4 billion, has been making strategic measures since the outbreak began in March 2020. Among his significant ventures, Ambani has entered the energy industry, expanded Jio’s reach with the launch of 5G services, and reinforced retail operations through the acquisition of Metro Cash & Carry.

Increasing Retail Dominance

Reliance Retail has taken a multi-format approach to ensure dominance across multiple segments. From Ajio.com and JioMart online to Reliance Trends and the soon-to-be-launched Azorte, the corporation is expanding its services to appeal to a diverse client base. Furthermore, Reliance Brands is home to well-known global brands, further reinforcing its market position. Reliance is well positioned to take a larger portion of the consumer wallet with the addition of private label brands.

Jio’s Business Success

Jio’s growth plan is centered on acquiring new subscribers, improving average revenue per user, and developing its 5G network. This strategy has produced amazing results, propelling Jio to become India’s largest telecom operator, with 426 million users and an average revenue per subscriber of 177. This achievement is reflected in the financials, which show a topline of 29,195 crore and a profit after tax of 4,881 crore.

Synergies and New Horizons

The convergence of Jio Financial Services and Jio’s telecom operations might be a game changer. Jio Financial Services has a huge net worth of 1,07,200 crore, giving it the ability to leverage and offer loans. Even with a gearing of five times net value, conservative assessments show that the theoretical borrowing capacity might be as high as 6,00,000 crore.

Using Green Energy

The plans to establish a new gigafactory in Jamnagar demonstrate Reliance’s commitment to green energy. This effort is consistent with the company’s commitment to sustainability and innovation, while precise reports on its development are yet awaited.

A Bright Future

Financial gurus have taken note of these trends. Brokerages are raising their outlook on Reliance Industries, citing the company’s excellent risk-reward balance as a result of strong profit growth. Despite an 8% drop in stock price, the business’s market capitalization is $15,87,500 crore, cementing its status as India’s most valuable company.

Looking Forward

Reliance Industries’ future contains promising opportunities. The implementation of green energy projects and the execution of 5G network expansion are critical issues to monitor. Reliance Industries is well-positioned to capture new business possibilities, thanks to strong reserves and reasonable borrowings. Because Mukesh Ambani frequently discloses significant initiatives at the Reliance AGM, the upcoming sessions may provide additional insight into the company’s future direction.