Research Question: How has a shift in the preference for the mode of transactions in Dehradun triggered a socio-economic revolution.

(Writer-Pranav Suri)

Introduction:

Money’s primary function has been as a standard medium of exchange as it is universally acceptable for transactions. The evolution of money has had its own history as it overcame the problems encountered with the barter system which was based on the cumbersome “coincidence of wants”.

Rapid strides in technology have further changed the characteristics of money where physical cash has been gradually replaced using the debit and the credit cards which are popular choices for those who do not wish to carry cash.

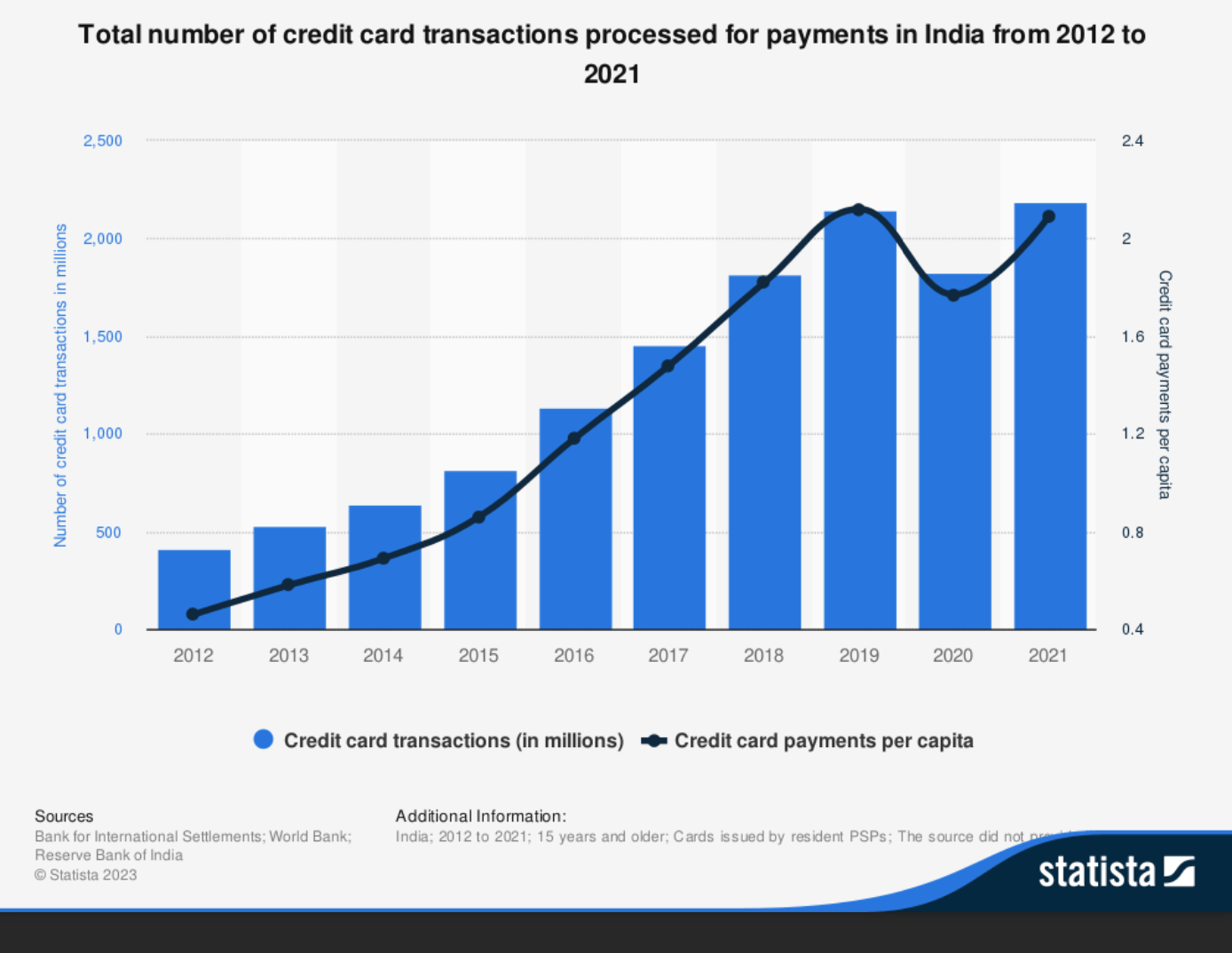

Collectively the debit and credit card transactions stood at 6.75 billion where the debit card contribution was 74% and the rest 26% by credit cards in FY 2020.

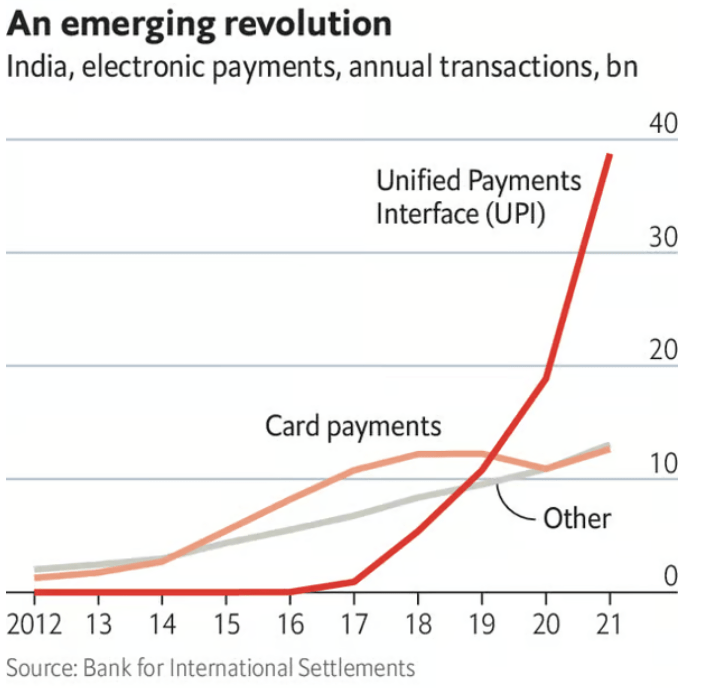

At the same time the nascent UPI which was launched in 2016 stood with an impressive 20 Billion transactions, representing 3x ahead of the card segment.

Before the launch of UPI in 2016, India’s digital payment landscape was fragmented and relied on various methods like NEFT, RTGS, and mobile wallets. These methods often required multiple steps, were time-consuming, and sometimes came with transaction fees. There was a lack of interoperability, making it challenging for users to transfer funds easily between different banks and payment platforms. The absence of a standardised, user-friendly system created significant barriers to the widespread adoption of digital payments in the country. The Unifying Payment Interface (UPI) is an highly advanced real-time payment system introduced by the National Payments Corporation of India (NPCI) to facilitate instant and secure cashless transactions between individuals and businesses. This allows users to send or receive money by using the UPI ID generated after creating an account. Since its launch in April 2016, UPI has played a pivotal role in revolutionising the digital payment landscape in India by providing a unified system that transcends the barriers of banks and payment service providers. This innovative platform has simplified the payment process and enhanced the overall convenience and security of digital transactions, making it a popular choice among users across the country. As the mobile penetration of India has increased multiple folds. As of 2016, the mobile internet penetration was at 19.66% which by 2020 had risen to 53.92% and has reached 70.93% in 2023, stimulating the increase in UPI based transactions at 83.71 billion which represents an increase of 70.71 billion since 2020.. UPI is the world’s most extensive online payment interface, processing around 40% of all real-time digital transactions worldwide.

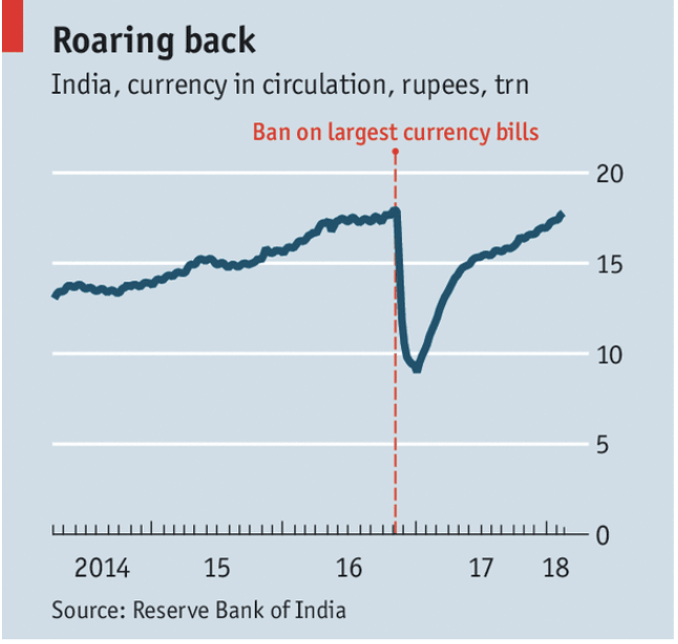

The rise in popularity for UPI can be attributed to the 2016 demonetisation. Unlike the Western world, in 2016, India did not have a high penetration of the banking system: which led to an increased number of undocumented transactions. This led to a high level of corruption, which led to demonetisation: the removal of 500 and 1000 rupee notes, in other words, removing 86% of all currency in circulation. The central bank could not keep up production of cash, leading to a shortage of physical cash.[1] The cash shortage soon superseded the initial apprehension of UPI, which led to the widespread adoption of UPI; for the past seven years, UPI has served as a digital payment interface and sparked a digital revolution in India. Since UPI’s arrival, the friction of cash has fallen, leading to increased consumption.

Over the years, I have seen a revolution of the traditional banking system. Shifting from cash to credit/debit cards and finally to such interfaces. While seeing this shift in the infrastructure, I have also seen a change in the mode of payments while purchasing items from street vendors, seemingly the overall consumption of such goods and services has risen due to the friction of money. In the following essay, I will be exploring to what extent has this technological revolution improved financial inclusivity, and hence living conditions for such vendors.

Methodology:

The data used in this essay can be categorised into 2 segments: Primary Data and Secondary Data.

Primary Data:

The primary data for this essay was collected in two ways: surveys and interviews.

The recipients of this survey were Indian citizens from different financial backgrounds. A total of 380 survey responses were recorded. A limiting factor to the research was that some recipients were not locals of Dehradun. Therefore, their experiences with UPI may have been different from those of this paper’s subjects. Secondly, I could not collect any quantitative primary data: the survey recipients were not open to sharing financial information with me; thus, the questionnaire was forced to be generalised. My second source of primary data collection was an interview that I conducted with the former CEO of Vodafone, Sir Arun Sarin. The interview was conducted to understand the birthplace of all digital transactions and why they started. However, as he was affiliated with M-Pesa, the information is only helpful for the background and a comparative study. Not having any direct use. Since Sir Sarin left Vodafone in 2008, he does not have recent information on how these digital transaction platforms have developed over the years.

Secondary Data:

My secondary data sources included research papers, economist articles and business reviews. I read research papers such as “The Great Indian Demonitisation” used to understand the context of the large-scale adoption of UPI. Further, I read research papers on M-Pesa and Alipay: as no papers have been written on the adoption of UPI. These papers helped me understand the impacts of digital transaction firms on the Economy, which will help me make a comparative analysis during the essay. Other than that, I researched different Cryptocurrencies to understand what went wrong with them and what potential threats UPI may face. The articles I chose were based on financial digital firms’ impact on the global market. Overall, the selection was varied, and I feel that all the perspectives were covered; however, since no direct UPI papers were available, I will have to make claims based on working in a similar economy.

Main Body:

In recent years, India has witnessed a remarkable transformation in the way its citizens conduct financial transactions. The use of conventional cash payments has significantly decreased because of contemporary, cashless alternatives as a result of technological advancements and governmental initiatives. This change highlights the growing significance of digital and mobile technologies in the lives of India’s as well as the nation’s developing financial landscape. The widespread use of mobile wallets and digital payment platforms has been one of the main factors in this change; for Indians, using these technologies has never been simpler, being able to complete daily tasks like paying bills, buying groceries, and sending money to friends and family with just a few waps on their smartphone. Services like Paytm, Google Pay, and PhonePe, are leading the charge.

Transitioning to a cashless economy through digital transactions and electronic payments offers numerous advantages. Primarily, it enhances convenience and accessibility for individuals and businesses. Digital payment systems, such as the Unified Payments Interface (UPI), eliminate the need for physical cash, allowing transactions to occur anytime and anywhere. This is particularly crucial in countries like India, where geographical barriers can hinder access to traditional banking services.

Cashless economies have been built upon the concept of financial inclusion. UPI and similar digital payment systems have allowed people who don’t have access to traditional bank accounts to now participate in the formal financial system. Virtual payment addresses (VPAs), have given even those in remote areas to engage in digital transactions further reducing their reliance on cash. Furthermore, adopting a cashless economy has several advantages, including increased accountability and openness. Digital transactions generate a distinct digital footprint that makes it easier to trace and monitor financial activities.For instance, the Indian government successfully used data gathered by UPI during the demonetization period to identify suspicious transactions, assisting their efforts to combat black money, money laundering, and other illicit financial practises; this increased transparency helps to lower corruption, tax evasion and helps improve overall financial integrity. With digital transactions becoming the norm, it becomes more challenging for individuals and firms to engage in tax evasion or hide income from the tax authorities. Since every financial transaction is electronically recorded, authorities may easily spot irregularities and successfully enforce tax compliance. As a result, the government earns more money, which can then be invested in public infrastructure and service improvements.

Before the pandemic, cash was the predominant payment method in India. However, the need for social distancing and avoiding physical contact made it difficult to conduct physical transactions; consequently leading to a sharp increase in the use of digital payments. Digital payments in India increased in value by 38% in 2020, totaling $1.2 trillion. Furthermore government promotion played a large role in this spike of digital payments. The government launched the Pradhan Mantri Garib Kalyan Yojana (PMGKY),a social welfare programme that offered financial aid to the underprivileged during the pandemic. The programme was implemented via the use of UPI, and it contributed to the payment system’s increased acceptance.

COVID-19 demonstrates how the use digital transactions can stabilise an economy. Digital payments offer a secure and practical method of making payments during a crisis and can also aid in preventing the spread of disease by removing the need for physical contact. Increased financial inclusion: Even those without bank accounts may now more easily access financial services thanks to digital payments. As a result, there is no longer a need for processing and managing cash, which has helped to decrease poverty and inequality. This has reduced the operating costs for enterprises, resulting in the creation of jobs and economic growth.

Digitisation has helped the economy be more resilient to shocks such as the COVID-19 pandemic. This is due to the fact that digital payments can be performed despite disruptions to the physical infrastructure. The government used UPI to make emergency transfers to street vendors and other vulnerable groups. This made it possible for these individuals to have access to the funds they needed to survive throughout the lockdown. UPI was also utilised by businesses to pay their suppliers and employees. This preserved jobs and kept businesses operating. Customers purchased groceries, medications, and other necessities using UPI. This helped the economy to keep running and avoided a sudden drop in demand.

The evolution of digital payments in India has gained remarkable momentum. Initiated by the “Digital India” campaign in 2015, online transactions have steadily risen. The Pradhan Mantri Jan Dhan Yojana facilitated the creation of over 260 million bank accounts, extending financial access to nearly all households. Alongside this, internet and smartphone usage surged, with Indians consuming 19.5 GB of data per user monthly on average[2]. This digital shift is projected to generate 69 million jobs by 2027[3]. Online payment wallets are mainly used for paying utility bills, shopping, and movie tickets. Microtransactions dominate the digital currency market with more than half of person-to-merchant transactions being below INR 100 . Over the past five years, India’s volume of digital payments has increased at an average annual rate of about 50%. That growth rate is already among the fastest in the world, but India’s unique, real-time, mobile-enabled system, the Unified Payments Interface (UPI), has seen growth that is even faster—by about 160 percent annually.[4] India’s digital payment ecosystem has outpaced other nations, even surpassing countries like the UK and China. Despite rural-urban disparities, the total transitions around the country amounted to 74.1 billion transactions.[5] The government’s efforts are evidenced, yet rural adoption remains limited. The number of participating banks increased by 40 percent from 338 in July 2022 to 473 in July 2023.[6] Additionally, the RBI unveiled a UPI for feature phones in March (older phones with buttons rather than touchscreens), which has the potential to link 400 million users in distant rural areas. Initiatives like Aadhar-enabled payments and AEPS have enhanced rural accessibility. The surge in digital platform usage, alongside falling prices, has driven internet users from 355 million in 2016 to 692 million in 2023. The number of internet users in India is expected to reach 900 million by 2025. Various modes of digital payments, such as NEFT, RTGS, IMPS, UPI, BHIM, credit/debit cards, and e-wallets, now define India’s financial landscape. The Reserve Bank of India’s committee aims to enhance the digital network’s penetration, reflecting the nation’s stride toward a cashless economy.

Figure 3: Total Number of digital transactions in India (2018-2023)

The financial landscape in India is undergoing a seismic transformation driven by the rapid onset of digitalization. Notably, between 2022 and December 2023, a remarkable surge of 58.4% was observed in the collective value of online financial transactions. This pronounced upswing echoes a pivotal shift in consumer preferences, gravitating towards technology-powered monetary exchanges, marking a decisive inflection point. An influential report by market research stalwart, WorldPay, solidifies this trajectory, revealing the overtaking of credit cards by digital wallets as the preferred payment method within India’s economic milieu by 2022.

The trajectory of UPI’s expansion over the last year has been nothing short of exponential, leaving a discernible impact on the competitive sphere. Emerging as a frontrunner, UPI outpaced prominent counterparts like Alipay, Mpesa, and Paypal, carving a substantive niche in the market. Notably, fiscal year 2021-2022 witnessed an impressive surge in transaction volume and a commendable escalation in transaction value, culminating in a staggering 4596.753 crore transactions totaling 84,17,572.48 crore INR. These figures, emblematic of the fiscal year concluding in 2021, underscore the potency of UPI’s trajectory.

As 2022-2023 unfolded, UPI’s unprecedented surge continued, culminating in an extraordinary transaction value of 1,39,20,675.21 crore INR by the year’s end. This milestone signifies a significant stride in the evolution of digital transactions. This trajectory gains additional credence when viewed through the historical lens. Notably, UPI transactions surpassed 800 million in March 2019, and this growth has continued ever since. Evidently, in the past, the rate of expansion of corresponding enterprises has lagged behind the growth of UPI transactions. This narrative demonstrates India’s tremendous progress towards a fully digital banking industry.

It is now easier for the government to track transactions and find tax evaders . This is because both individuals and corporations must now file their taxes online and make payments using electronic means, which is all on record. The government has also employed big data and artificial intelligence to identify suspected tax evaders.

As an illustration, the Indian government established the Goods and Services Tax Network (GSTN), a centralised IT system for managing and collecting GST. The GSTN has aided in boosting tax collection efficiency and lowering the prevalence of tax evasion. India saw the number of taxpayers increase by 100% due to the introduction of GSTN; going from 70 lakh in 2017 to 1.4 crore payers in 2022.

In the city of Dehradun, digital payments have evolved into the unspoken standard. This is due to a number of factors, including the growth in available digital payment choices, greater awareness of the benefits of digital payments, and government actions to support them. Because more people are now making digital payments, this improves the tracking and collection taxes for the government; as a result, tax collection in Dehradun has increased by 14% in 2023. From Rs1887 to Rs2148 crores. This is because the government can more easily identify and follow tax evaders thanks to digital payments’ increased traceability compared to cash payments.

The digital revolution has aided India’s economic growth as well. This is because the revolution has made it simpler for companies to run their operations and attract new clients. By 2025, it is predicted that India’s e-commerce market would have contributed $1 trillion to the country’s GDP. Many of the firms in Dehradun have benefited from the digital revolution.

The digital revolution has also helped India to achieve its macroeconomic goals. The digital revolution has helped to reduce the fiscal deficit in India by 1% of GDP. Allowing the government to set a target of reducing the fiscal deficit to 3% of GDP by 2025. By making it simpler to track spending and collect taxes, the digital revolution can assist in achieving the government to raise more money. The digital era in Dehradun has aided the administration in strengthening its fiscal oversight. Dehradun’s digital economy is thought to be worth $100 million, which makes a sizable contribution to the city’s overall economy. The government now tracks its spending and revenue via digital platforms. The government has been able to distribute its resources more wisely as a result of this. Overall, tax collection, economic expansion, and macroeconomic objectives in India have benefited from the digital revolution.

The digital revolution has also helped India to achieve its macroeconomic goals. The digital revolution has helped to reduce the fiscal deficit in India by 1% of GDP. Allowing the government to set a target of reducing the fiscal deficit to 3% of GDP by 2025. By making it simpler to track spending and collect taxes, the digital revolution can assist in achieving the government to raise more money. The digital era in Dehradun has aided the administration in strengthening its fiscal oversight. The government now tracks its spending and revenue via digital platforms. The government has been able to distribute its resources more wisely as a result of this. Overall, tax collection, economic expansion, and macroeconomic objectives in India have benefited from the digital revolution.

Moreover, the digital transformation has significantly impacted consumer behavior and business operations. Small businesses and entrepreneurs have capitalized on digital platforms to reach wider markets, enhance their customer service, and improve operational efficiencies. This digital shift has also led to the creation of new job opportunities in sectors such as e-commerce, fintech, and digital marketing, contributing to the nation’s economic diversity and resilience.

Environmental impacts of the digital payment revolution should not be overlooked. The reduced reliance on physical currency has implications for the environment, as it decreases the need for printing paper money and minting coins, both of which have ecological footprints. Additionally, the rise in digital transactions has led to a decrease in the carbon footprint associated with the transportation and security of physical cash.

Socially, the digital payment systems have played a crucial role in promoting financial literacy and inclusion. People in remote areas, who were previously excluded from the formal banking system, now have access to financial services. This inclusion has empowered them economically and contributed to reducing income inequality in the country.

Conclusion:

In conclusion, the shift from traditional cash-based transactions to digital payments in India is not just a mere change in the method of monetary exchange. It represents a profound transformation in the socio-economic fabric of the country. This revolution has enhanced financial inclusivity, bridged the rural-urban divide, and fostered a more transparent and efficient economy. As India continues on this path, it is crucial to ensure that the benefits of this digital transformation are equitably distributed and that the country’s digital infrastructure continues to evolve to meet the changing needs of its citizens. The journey of India’s digital payment landscape is a testament to the power of technology in reshaping economies and, indeed, the daily lives of millions of people.

- Lahiri, Amartya. “The Great Indian Demonitisation” Journal of Economic Perspectives, vol. Volume 34, no. Winter 2020, pp. 55-74. ↑

- “Here’s how much average data Indians are consuming in a month – Times of India.” The Times of India, 16 February 2023, https://timesofindia.indiatimes.com/gadgets-news/heres-how-much-average-data-indians-are-consuming-in-a-month/articleshow/97984759.cms. Accessed 1 September 2023. ↑

- “Indian job market to see 22 pc churn in 5 yrs; AI, machine learning among top roles: WEF.” The Economic Times, 1 May 2023, https://economictimes.indiatimes.com/jobs/hr-policies-trends/indian-job-market-to-see-22-pc-churn-in-5-yrs-ai-machine-learning-among-top-roles-wef/articleshow/99900870.cms?from=mdr. Accessed 1 September 2023. ↑

- “Digital-Journeys: India embraces mobile money.” International Monetary Fund, https://www.imf.org/en/Publications/fandd/issues/2022/09/Digital-Journeys-India-embraces-mobile-money-Kearns-Mathew. Accessed 1 September 2023. ↑

- “NPCI UPI Product Statistics.” NPCI, https://www.npci.org.in/what-we-do/upi/product-statistics. Accessed 1 September 2023. ↑

- “NPCI UPI Product Statistics.” NPCI, https://www.npci.org.in/what-we-do/upi/product-statistics. Accessed 1 September 2023. ↑